In today's fast-paced legal realm, efficiency is paramount. Law firms and corporations are constantly seeking innovative ways to optimize operations and streamline processes. One area ripe for improvement is case tracking. Traditionally, analog methods have been employed, often leading to inefficiencies, errors, and lost time. A viable solution lies in staff automation, specifically the incorporation of software tools designed to automate case tracking procedures.

- These systems harness technology to centralize case information, providing a single source of truth for all parties involved.

- Furthermore, automation streamlines tasks such as document management, communication tracking, and deadline reminders, freeing up staff time to focus on complex legal concerns.

Consequently, law firms can boost client service by providing timely updates and responsive communication. Moreover, automation mitigates the risk of human error, ensuring accuracy and compliance with legal regulations.

Boosting Financial Service Delivery Through Intelligent Automation

Financial services are facing a significant transformation, fueled by the power of intelligent automation. By embracing AI-powered technologies, financial institutions can streamline service delivery, boost customer engagement, and decrease operational costs.

Robotic Process Automation (RPA) can automate manual tasks such as data entry, settlement processing, and user assistance, freeing up human employees to devote their attention to more value-added initiatives. This not only streamlines efficiency but also minimizes the risk of human error, leading to greater precision.

{Moreover|Furthermore, intelligent automation can customize financial products based on specific needs. By interpreting vast amounts of customer data, AI algorithms can generate relevant suggestions, improving the overall customer journey.

Streamlining Compliance Monitoring Through Automation

In today's dynamic business landscape, organizations face a complex web of compliance requirements. Failure to meet these regulations can result in significant financial penalties and damage an organization's reputation. Therefore, automating compliance monitoring has emerged as a crucial strategy for enhancing risk management.

Automated systems can systematically scan vast amounts of data, identifying potential violations in real time. This enables organizations to mitigate risks swiftly and effectively. By leveraging automation, businesses can free up valuable resources to focus on strategic initiatives

- Moreover, automated systems can generate comprehensive reports that provide insights into compliance performance. These reports allow organizations to measure their progress over time and identify areas for optimization.

- Ultimately, automating compliance monitoring provides a multitude of benefits, including reduced risk exposure, improved efficiency, and enhanced decision-making capabilities.

Case Management Platform Empowering Efficiency and Transparency

A robust Legal Case Tracking System is indispensable Compliance Monitoring for any progressive legal practice. These systems provide a centralized platform for managing all aspects of a case, from initial filing to final resolution. By optimizing key tasks and providing instantaneous updates, these systems drastically improve efficiency and transparency.

With a Legal Case Tracking System in place, attorneys can easily access case files, arrange appointments, monitor deadlines, and collaborate with clients and colleagues. This optimized workflow minimizes administrative burdens, allowing legal professionals to devote more time to client matters.

- Additionally, Legal Case Tracking Systems often feature advanced reporting tools, providing valuable trends that can guide strategic decision-making.

- Concisely, the implementation of a Legal Case Tracking System empowers legal practices to operate with greater efficiency, transparency, and success.

Streamlining Financial Operations Through Staff Automation: Enhancing Accuracy and Productivity

In the constantly shifting landscape of financial services, institutions are relentlessly pursuing to optimize operations for enhanced accuracy and productivity. Staff automation has emerged as a transformative solution, enabling financial professionals to seamlessly handle demanding tasks with exceptional precision. By optimizing repetitive and data-driven processes, staff automation empowers employees to focus their time and skills to value-adding initiatives that directly impact the organization's success.

Through advanced automation technologies, financial services can attain a number of significant advantages, including:

* Reduced inaccuracies

* Increased efficiency and productivity

* Simplified workflows

* Improved customer satisfaction

Modernizing Compliance: How Automated Monitoring is Transforming the Landscape

In today's complex regulatory environment, organizations face an unprecedented demand to ensure comprehensive compliance. Manual monitoring methods are often time-consuming, leading to increased risk and operational costs. To address these challenges, next-generation compliance solutions are gaining traction the industry by harnessing the power of intelligent monitoring technology. These solutions leverage machine learning to identify potential violations in real time, enabling organizations to proactively mitigate threats and maintain a strong compliance posture.

- Benefits of Automated Monitoring Solutions include:

- Enhanced Efficiency

- Reduced Risk

- Cost Savings

By embracing automated monitoring, organizations can transform their compliance programs, enhancing operations and reducing the risk of penalties. As technology continues to develop, we can expect even more innovative solutions to emerge, further shaping the future of compliance.

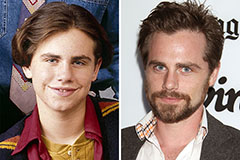

Rider Strong Then & Now!

Rider Strong Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!